Mumbai : India’s leading commodity derivatives exchange, Multi Commodity Exchange (MCX) has recorded turnover of Rs.129805.06 crores in various futures & option contracts for commodities listed at MCX on Friday, April 11, 2025 till 5:00 pm. In which commodity futures accounted for Rs. 22689.99 crores and options on commodity futures for Rs. 107113.59 crores (notional). Bullion Index MCXBULLDEX Apr-25 futures was reached at 21425.

Commodity Future Contracts:

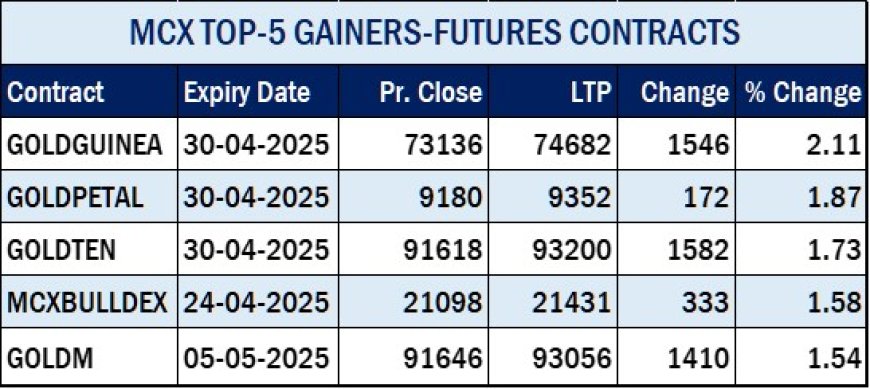

Bullion: In precious metals, Turnover of GOLD and SILVER futures variants clocked Rs. 18022.18 crores. At the time of writing, MCX GOLD futures, with June-2025 expiry contract opened at Rs. 92463 per 10 grams, touched an all-time high of Rs. 93736, touched a low of Rs. 92463, and rose by Rs. 1425 to Rs. 93458 against the previous close of Rs. 92033. GOLDTEN April-2025 contract was up by Rs.1618 or 1.77% to Rs. 93236 per 10 gram, GOLDGUINEA April-2025 contract was up by Rs.1547 or 2.12% to Rs. 74683 per 8 gram and GOLDPETAL April-2025 contract was up by Rs.175 or 1.91% to Rs. 9355 per gram. On other hand, GOLDM May-2025 contract was up by Rs.1421 or 1.55% to Rs. 93067 per 10 gram.

SILVER futures, with May-2025 expiry contract was up by Rs.1049 or 1.15% to Rs. 92644 per kg, while SILVERM April-2025 contract was up by Rs.1054 or 1.15% to Rs. 92750 per kg and SILVERMIC April-2025 contract was up by Rs.1067 or 1.16% to Rs. 92753 per kg.

GOLD futures clocked turnover of Rs. 9261.93 crores with volume of 9917 lots and OI of 22297 lots while SILVER futures clocked turnover of Rs. 2909.85 crores with volume of 10454 lots and OI of 26031 lots.

Base Metal: Turnover of base metal futures products accounted for Rs. 2336.27 crores. COPPER April-2025 contract was up by Rs.10.5 or 1.27% to Rs. 837.7 per kg and ZINC April-2025 contract was up by Rs.2.75 or 1.09% to Rs. 255.35 per kg while ALUMINIUM April-2025 contract was up by Rs.1.95 or 0.83% to Rs. 235.85 per kg and LEAD April-2025 contract was up by Rs.0.55 or 0.31% to Rs. 177.9 per kg.

COPPER futures clocked turnover of Rs. 1629.67 crores, ALUMINIUM futures Rs. 212.66 crores, LEAD futures Rs. 52.71 crores, and ZINC futures clocked turnover of Rs. 293.49 crores.

Energy: Turnover of energy futures products contributed for Rs. 2360.35 crores. CRUDEOIL April-2025 contract was up by Rs.20 or 0.39% to Rs. 5189 per BBL while NATURALGAS April-2025 contract was down by Rs.0.9 or 0.3% to Rs. 302.2 per MMBTU.

CRUDE OIL futures clocked turnover of Rs. 1106.46 crores and NATURAL GAS futures Rs. 974.02 crores.

AGRI: MENTHAOIL April-2025 contract was up by Rs.13.3 or 1.46% to Rs. 926 per kg .

Options on Commodity Future Contracts:

Commodity Options accounted for Rs. 107113.59 crores turnover (notional), having premium turnover of Rs. 1988.83 crores.

CRUDE OIL Options: Most traded contracts among CRUDE OIL Options were Call Option April-2025 contract at Strike price of Rs.5200 was up by Rs.9.5 or 7.22% to Rs. 141.00 with volume of 116121 lots & OI of 11821 lots, while CRUDE OIL Put Option April-2025 contract at Strike price of Rs.5200 was down by Rs.5.9 or 3.62% to Rs. 157 with volume of 120936 lots & OI of 10436 lots.

NATURAL GAS Options: Most traded contracts among NATURAL GAS Options were Call Option April-2025 contract at Strike price of Rs.310 was up by Rs.0.8 or 6.32% to Rs. 13.45 with volume of 15129 lots & OI of 3955 lots, while NATURAL GAS Put Option April-2025 contract at Strike price of Rs.300 was up by Rs.1.2 or 8.48% to Rs. 15.35 with volume of 18790 lots & OI of 6232 lots.

GOLD Options: Most traded contracts among GOLD Options were Call Option April-2025 contract at Strike price of Rs.95000 was up by Rs.639 or 88.63% to Rs. 1360 with volume of 1758 lots & OI of 778 lots, while GOLD Put Option April-2025 contract at Strike price of Rs.90000 was down by Rs.202.5 or 20.89% to Rs. 767 with volume of 2853 lots & OI of 952 lots.

SILVER Options: Most traded contracts among SILVER Options were Call Option April-2025 contract at Strike price of Rs.93000 was up by Rs.493.5 or 30.65% to Rs. 2103.5 with volume of 1748 lots & OI of 389 lots, while SILVER Put Option April-2025 contract at Strike price of Rs.92000 was down by Rs.465 or 19.61% to Rs. 1906 with volume of 1291 lots & OI of 280 lots.

Previous

Article

Previous

Article