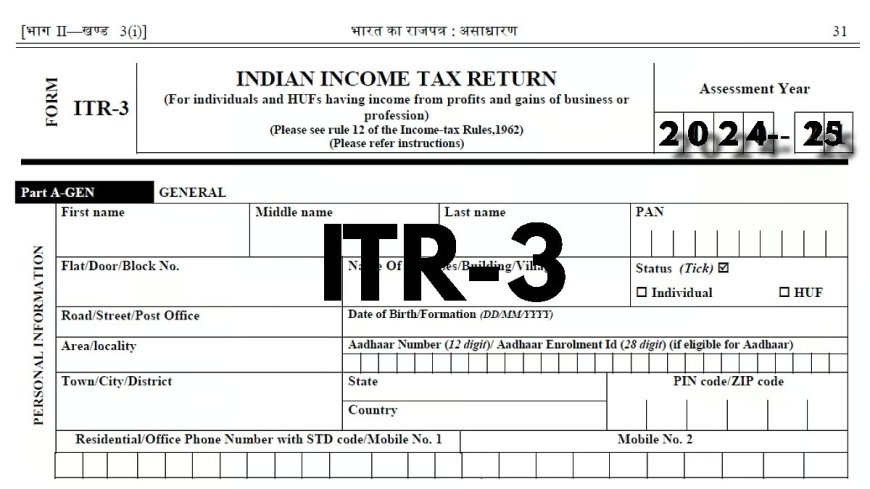

New Delhi, May 8, 2025 : The Income Tax Department has officially released the revised ITR-3 form for the Assessment Year 2024-25, introducing a host of significant changes for taxpayers earning income from business or profession. Applicable to individuals and Hindu Undivided Families (HUFs), the updated form is part of a broader effort to streamline the tax filing process and ensure better income and asset reporting.

Among the key updates is the addition of a new column in the Schedule CG section, allowing taxpayers to declare the holding period of capital assets. This change is expected to bring clarity in reporting capital gains, particularly distinguishing between short-term and long-term holdings.

In line with this, a specific column has been introduced under Section 50 for reporting short-term capital gains on depreciable assets, such as machinery and vehicles—marking a focused approach to accurately record gains from assets that reduce in value over time.

A notable policy shift sees the new tax regime becoming the default option. Taxpayers wishing to continue with the old regime will now need to submit Form 10-IEA proactively.

Additionally, compliance requirements around tax deduction at source (TDS) have been tightened. E-commerce operators must now report 1% TDS on business income under Section 194Q, while businesses are also required to disclose TDS on benefits and perks provided to others under Section 194R.

The Income Tax Department has also made electronic filing mandatory for all businesses with annual income exceeding ₹5 crore. Moreover, taxpayers with foreign assets or income must declare these details under the newly emphasized Schedule FA, aimed at curbing tax evasion through foreign holdings.

To support taxpayers through these changes, the Department has pledged to offer additional guidance and resources via its official website, including simplified explanations and user-friendly tools.

These reforms, effective from April 1, 2025, reflect the government's ongoing push toward greater transparency and digital governance in the country’s tax system.

Previous

Article

Previous

Article